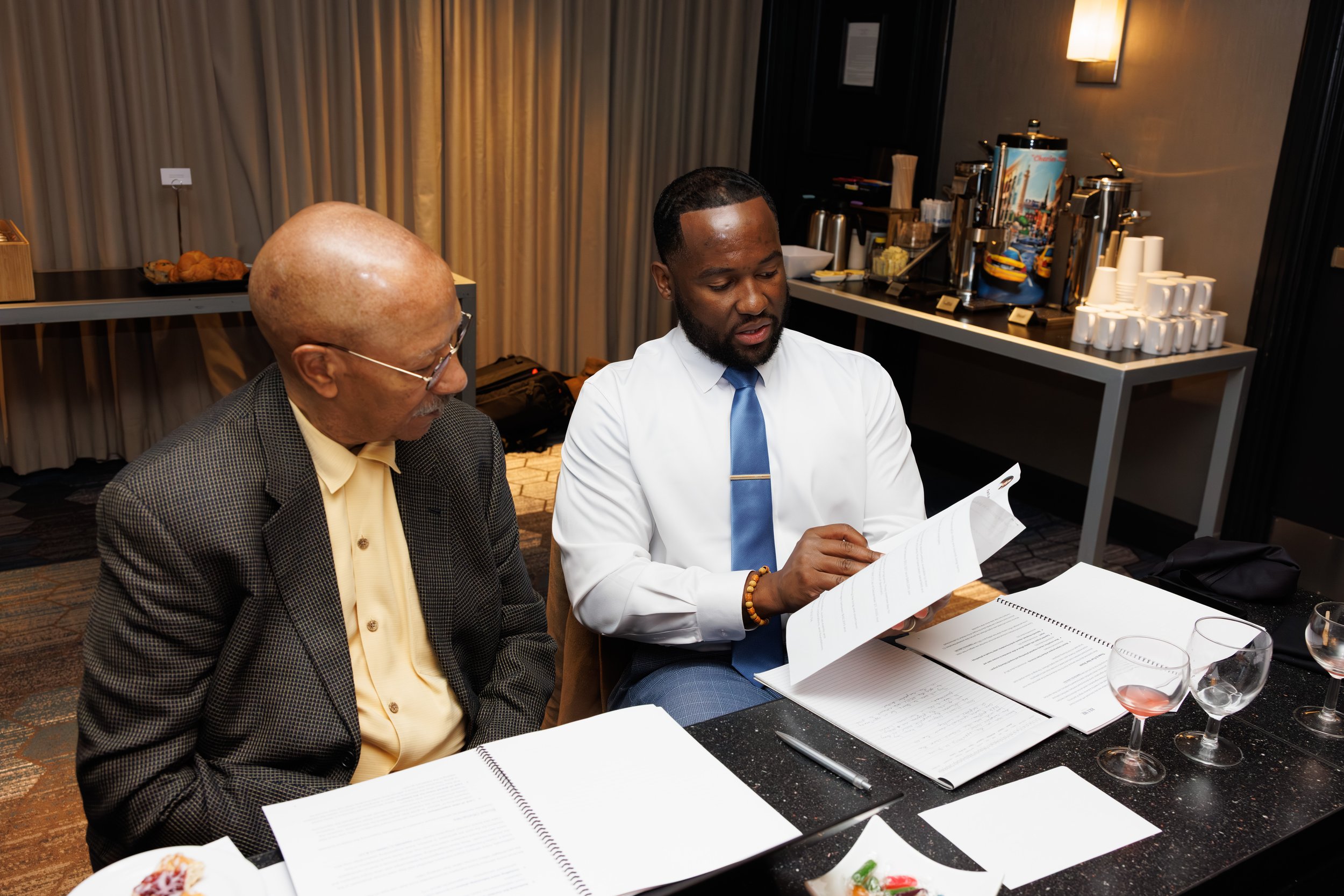

Meet Stanley

For nearly a decade, I taught AP and IB Psychology to high school students, helping them understand why people make the decisions they do and what drives behavior. Today, I use those same insights as a financial coach because money problems are rarely about math. But the more I taught, the more I realized: These same principles explain everything about money.

Why do smart people stay in debt? Why does investing feel terrifying even when the math makes sense? Why do we know what we should do with money but don't do it?

The answer: Money is psychological before it's mathematical.

That realization led me to complete the Personal & Family Financial Planning program through the University of Florida. Today, I work in philanthropy helping families access resources to thrive. For the past 6 years, I've also coached real people through the messy, emotional world of personal finance.

I've helped clients:

Build emergency funds from zero (even when they thought they couldn't)

Choose the right investments for IRAs and 401(k)s without overwhelm

Save thousands in fees by switching to low-cost index funds

And actually understand what they're investing in

My approach is simple:

I don't believe in shaming you about spending or that you need to sacrifice everything you enjoy to build wealth.

What I do believe:

Financial freedom is possible for regular people with regular incomes

Small, consistent actions beat perfect plans you never start

Understanding why you make money decisions matters more than formulas

The right plan gives you peace of mind, not more anxiety

Why "9to5Finance"?

Because most of us work a 9-to-5. We're not trust fund kids or tech millionaires. We're teachers, nonprofit workers, corporate professionals—regular people trying to make our money work as hard as we do.

And we deserve financial guidance that makes sense for our lives.

You don't need to figure this out alone. Let's build your plan together.

Why 9 to 5 Finance Exists

You make decent money. You work hard. So why do you still feel financially stuck?

You're not alone and you're not broken:

72% of working Americans are financially stressed, even those earning six figures.

The average American carries $105,000 in total debt, including $6,730 in credit card debt alone

40% (2 in 5) can't cover a $1,000 emergency without going into more debt

Only 35% have investments outside their 401k because investing feels like it's "for rich people"

1 in 4 believe they'll never retire

Here's what the financial industry won't tell you: Money is psychological before it's mathematical.

The system failed to teach you how money actually works. It gave you shame instead of systems. Jargon instead of clarity.

9to5 Finance exists to give you back control.

We help everyday professionals build financial confidence through simple systems that work—so you can cover emergencies without panic, invest without confusion, build your credit without stress, and finally enjoy your life today without guilt about tomorrow.

Your peace of mind doesn't require perfection. It requires a plan you can actually follow.

Contact us

Interested in working together? Fill out some info and we will be in touch shortly. We can’t wait to hear from you!